Strategy Setup Risk Management & Exit Plan

Hello Traders!

This post is for those who want to generate passive monthly income by leveraging the power of non-directional option selling. Based on current Nifty structure and OI data, I have spotted a range-bound opportunity — perfect for executing a safe, hedged Iron Condor Strategy.

Why This Strategy Now? (Based on Chart Analysis)

- Resistance Zone: 25000–25200 (Heavy supply, multiple rejections visible)

- Support Zone: 23400–23250 (Major bounce levels, strong OI support)

- Nifty is currently trading near 24325, well inside this range — perfect for deploying a neutral premium-eating setup.

Strategy Setup (Iron Condor – 29 May 2025 Monthly Expiry)

- Sell 25200 CE @ ₹124.25

(Resistance-based upper strike) - Buy 25800 CE @ ₹38.60

(Hedge to protect against breakout) - Sell 23400 PE @ ₹157.05

(Support-based lower strike) - Buy 22800 PE @ ₹91.40

(Hedge to protect against breakdown)

Why This Works? (OI Logic + Technical View)

- Strong resistance visible at 25000–25200 zone with increasing call OI

- Solid put writing seen at 23400 & 23500 strike — confirming downside support

- Volatility is stable, time decay is in our favor — making this ideal for Iron Condor sellers.

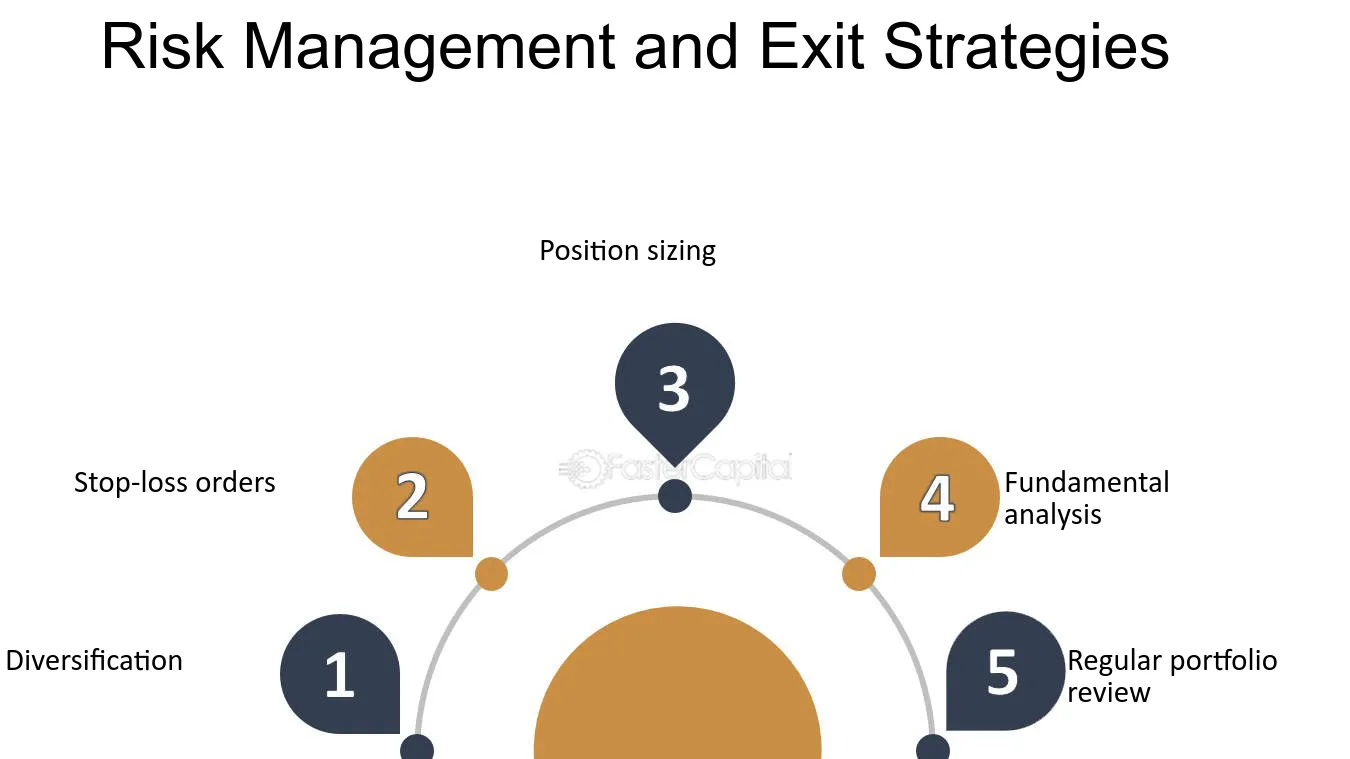

Risk Management & Exit Plan

- Exit early if either side breaks with volume

- Don’t hold till expiry — aim to exit around 70–80% of max profit

- Always keep SL alert at breakeven range breakouts

Rahul’s Tip

“Option writing is not for thrill, it’s for discipline. Iron Condor is a weapon when range is visible — use it like a sniper, not a gambler.”

Conclusion

If you believe Nifty is likely to stay between 23400–25200 for the next few weeks, this Iron Condor setup offers great risk-managed income potential. Use proper lot sizing and risk control — and let theta do the work for you!

Have you ever deployed an Iron Condor on Nifty? What was your experience? Drop your thoughts in the comments!

If you found this post valuable, don’t forget to LIKE and FOLLOW!

I regularly share high-quality trading setups based on real analysis, OI data, and smart risk management strategies.

Disclaimer: This analysis is for educational purposes only. Please consult a financial advisor before making investment decisions.