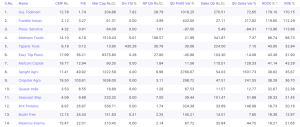

Here you get all NSE/BSE penny stocks, sorted by market capitalization. These low-priced stocks are often highly speculative but can offer substantial returns if the company grows. They are generally from smaller companies and are suitable for investors with a high-risk tolerance looking to invest in emerging businesses.

01

How to choose Penny Stocks Under 1 Rs while investing?

02

What are the advantages of investing in Penny Stocks Under 1 Rs?

03

What are the risks associated with Penny Stocks Under 1 Rs?

04

Are Penny Stocks Under 1 Rs suitable for beginners in stock market?

05

Are Penny Stocks Under 1 Rs a good investment?